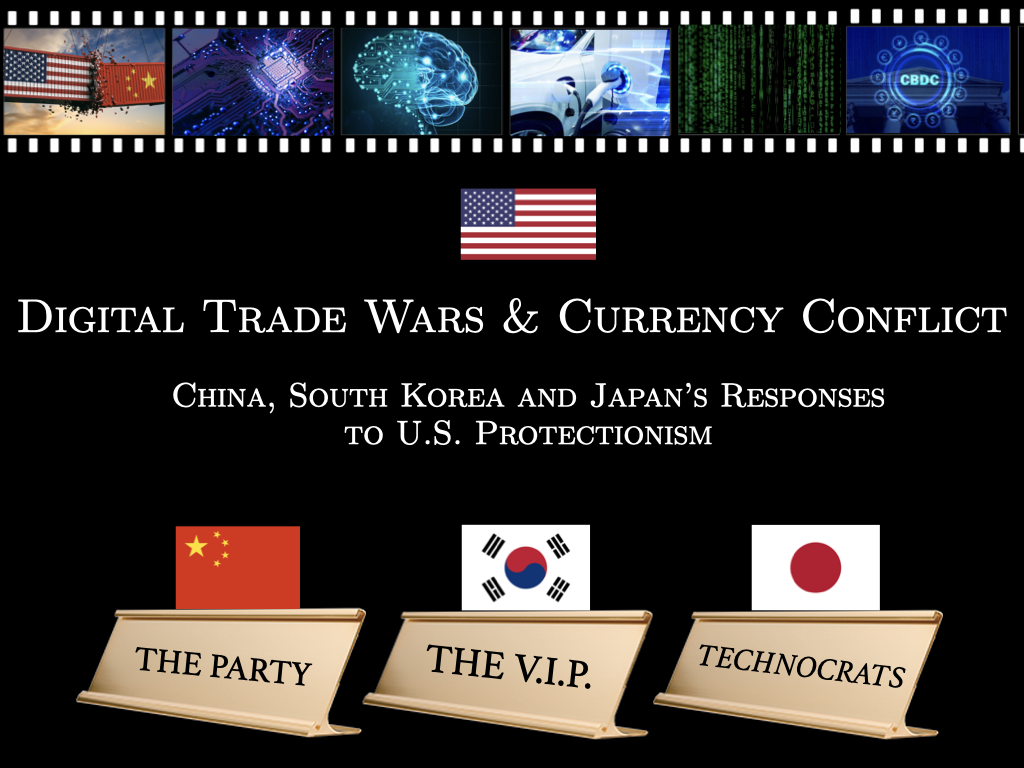

Why do the export economies of Asia – China, Korea and Japan – respond differently to U.S. pressures in the digital economy?

Chips, data, and digital finance are shaping the global leadership into the post-pandemic era. During the COVID-19 pandemic, supply chains disruption compelled the U.S. and China to weaponize it, and under contactless economy the digital transition and tech became the centerpiece of hegemony. Efficiency based on interdependence no longer suffices and self-sufficiency matters a great deal under persisting geopolitical risk. The global chip shortage during the pandemic has prompted the U.S. to consolidate semiconductor production capacity within its own territory/alliance system, amid the continued global debate on equal access to COVID-19 vaccines (“chips for jabs” in the case of certain U.S. allies). Digitalization is accelerated in the contactless economy in the absence of a global regulatory framework on data governance. Cashless societies are emerging at a rapid pace, and central banks have shifted their policies to launch digital currencies within centralized finance, while declaring intent to regulate decentralized finance. All the while, cyberspace becomes a breeding ground for hacking of critical infrastructure and financial institutions (e.g., energy grids, banks) under the lack of regulatory measures.

At such a pivotal point of digital transformation, this book aims to explain the reasons as to why China, South Korea and Japan’s responses to U.S. protectionist pressures under COVID-19 are different. This book argues that the East Asian states responses have not been uniform, not merely owing to the geopolitical underpinnings of the bilateral relationships, but because of the institutional variance in policymaking regarding digital transformation in each jurisdiction. For the longest time, scholars have relied on the existence of bilateral security alliances in order to gauge policy responses from U.S. trading partners in times of U.S. economic pressures.

This book offers an alternative narrative of governance by institutions and technological capacity that is wielded as policy leverage, and suggests a framework for predicting state responses and argues through a three-step process:

- assessing industrial rigor and competitiveness via technological capacity in each critical sector (semiconductors and vaccines, connectivity in 5G/6G, EVs and batteries, data governance and AI, digital finance);

- identifying the dominant policy maker on the digital economy based on the levels of bureaucratic autonomy, and deciphering its policy preference;

- comparing the dynamics of triangular ‘industry–state–bureaucracy’ dynamics per critical sector in digital trade and currency conflict.

Through the empirical findings and analysis using the institutional framework, this book argues that China has struck back, South Korea has hedged, and Japan has stood in line with the U.S. upon U.S. pressures in the digital economy since COVID-19. It argues that the varied responses are attributed to the nexus of the industry-state-bureaucracy.

This book manuscript is supported by the Individual Impact Grant for 2022 International Strategy Forum (ISF) Fellows by Schmidt Futures (G-22-63371) and has been enriched by the 2019-2020 Next Generation Researchers Grant of the National Research Foundation of Korea (NRF-2019S1A5B5A07106479). Built on the theoretical framework of institutional variance developed in my PhD dissertation based on-site research consisting of interviews with government officials, policy analysts, lawyers, academics, and business persons in addition to archival research in Tokyo, Seoul, Beijing, and Washington, DC (2010-20), the updated cases on digitalization during COVID-19 make the central thesis of the book a compelling argument for our time and provides a tool for policy projection into the digital economy in the post-pandemic era.

Chapter 0. |

PREFACE: Trade Wars and Currency Conflicts in the Digital World From Trump’s Tariff Wars to Biden’s Export Controls amid COVID-19 and the War on Ukraine Post-Pandemic Ecosystems of the Digital Future driven by AI: Chips, Jabs, EVs, Data, and Coins Why East Asian Economies are Not the Same: China Readies a War, South Korea sits on the Fence, and Japan Adheres to the U.S. |

Chapter 1. |

INTRO: The U.S. Plays the Same Game in TechTwo Elephants in the Ring: The U.S. and China since COVID-19 The Puzzle: Why do they respond differently? Policy Relevance Argument: ‘Institutional Variance’ in the Digital Transformation Research Design, Data and Methodology Contributions Outline of the Book |

Chapter 2. |

HISTORY: How the Old, the New, and the Final Target came to Respond Protectionist Measures Remodeled since the WTO Dominant Players in Trade Wars and Currency Conflict The Recurring Cycles of Pressures and Responses The Old Target Responds: Japan The New Target Responds: South Korea The Final Target Responds: China |

Chapter 3. |

STAKES: Inside Today’s Tech Wars on the Path to Digital Futures ‘U.S. Pressures 3.0’: Biden’s Unilateral Multilateralism and Tech War with China The Baseline Scenario: Tariffs and ‘Value-based’ Pressures on Allies The Export Control Reform Act of 2018 and Reinforced Measures at the BIS to Block Tech Transfer to China The National Security Clause at the WTO and the Fate of the WTO DSB Blocking Outward Investment to China by the U.S. Treasury and CFIUS Digital Currencies: CBDC Development to Deter Crypto and the Rise of the Digital Yuan The Digital Future: Tech, Energy, and Coins Tech – Data, Chips, 5G and AI Energy – From fossil fuel and nuclear to renewables and electrification Coins – The Path Toward Digital Currencies and Blockchains The Aftermath of the Digital Trade Wars and Currency Conflict |

Chapter 4. |

ARGUMENT:Predicting Policy Moves by Institutional Variance – the ‘Industry-State-Bureaucracy’ Nexus Theorizing Institutional Variance in Digital Policymaking and Responses Limitations of Existing Explanations on Bureaucratic Decision-making The Framework of Institutional Variance in Responses -Industrial Capacity toward Digitization -Political Systems, Bureaucratic Autonomy, and Businesses -The Dominant Decisionmaker’s Policy Preferences The Key to Utilizing Institutional Variance for Policy Prediction |

Chapter 5. |

RESPONSES:Varying Degrees in Responses to Pressures China: “Retaliate.” -Political System: Authoritarian -Bureaucratic Autonomy: None, only empowered -State-Business Relations: Business gripped by the State -Dominant Players: The Party - the CFEAC and the CNSC -Policy Preferences: Escalation South Korea: “Hedge.” -Political System: Presidential -Bureaucratic Autonomy: Some but subservient -State-Business Relations: Business bargaining with the State -Dominant Players: The V.I.P. and presidential aides -Policy Preferences: Balancing Act Japan: “Follow.” -Political System: Parliamentarian -Bureaucratic Autonomy: High as a technocracy -State-Business Relations: Business at arm's length from the State -Dominant Players: The Technocrats of MOF & METI supported by the PM -Policy Preferences: Adherence |

Chapter 6. |

CASES: Digital Trade Wars The Chip War: The Race for Supremacy in Future Industries (Subsidiary case: COVID-19 Vaccines and Semiconductor Supply Chains) Pressures: U.S. Entity List and Export Controls on Semiconductor/Equipment China: The Revitalization of Huawei through partnership with SMIC South Korea: Samsung rivaling TSMC and Intel, with foundry operations in U.S. and China Japan: In line with the U.S. on Huawei ban, and hosting TSMC plant in Kumamoto Electric Vehicles and Batteries toward Net-Zero and Rare Earths Pressures: U.S. Inflation Reduction Act and EV Subsidies China: Lion’s share of the critical minerals and battery market by CATL South Korea: LG Energy Solutions at CATL’s tail and joint partnerships/factories with U.S. automakers Japan: Late in the game, Toyota partnering with Panasonic Data Governance and Digital Trade Agreements (Subsidiary case: Transfer of Data, 5G/6G Connectivity, with autonomous driving considered) Pressures: U.S. Huawei Ban (5G), Open-RAN (6G) (No Global Framework on Digital or Data) China: Personal Information Protection Law (PIPL) and Data Security Law South Korea: Personal Information Protection Act (PIPA) Japan: Act on the Protection of Personal Information (APPI) |

Chapter 7. |

CASES: Digital Currency Conflict

Digital Currencies in CeFi (CBDCs) and DeFi (Cryptocurrencies/Stablecoins)

Pressures: Fed big steps to portray strong dollar amid inflation amid de-dollarization,

U.S. SEC crackdown on crypto while the Fed seeks consultation with Congress on CBDCs

China: Crackdown on DeFi and everything non-CeFi

South Korea: Between regulating Cryptocurrencies (DeFi) and launching a CBDC (CeFi)

Japan: Studying a CBDC (CeFi) but not outlawing DeFi in line with the U.S.

|

Chapter 8. |

CONCLUSION: Applying the Triangular Framework in Digital Trade Wars and Currency Conflict Elsewhere Recognizing the New Normal of U.S. Pressures 3.0 in which the U.S. is no longer No. 1 Utilizing the Triangular ‘Industry-State-Bureaucracy’ Framework as Policy Predictor China, South Korea and Japan are different tech players Considering Applicability by the EU and the UK, and the Gulf States |

Chapter 9. |

Epilogue: It’s ‘Who Decides’ and ‘Who Has’ that shape the Responses Strategies for the Future based on Anticipated Responses |