Fast Facts:

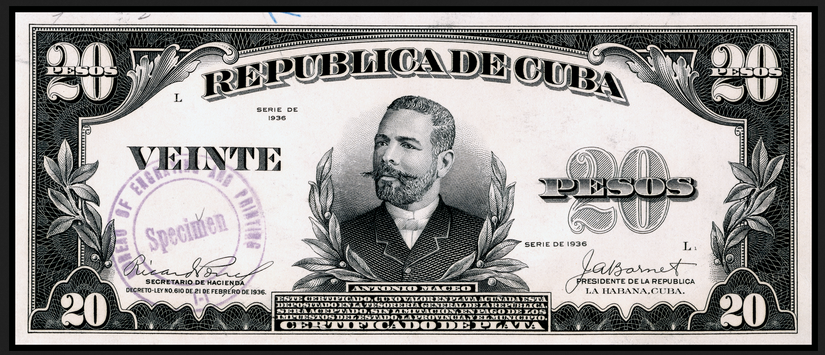

– Cuba has two currencies. The Cuban convertible peso (CUC) is used solely by tourists and is pegged to the USD. The Cuban peso (CUP) is used by locals.

– Based on current exchange rates, the CUP is worth 25 times less than the CUC and USD.

– Bartering is still a common practice in rural areas.

Overview:

Money is an important component of every country and society. Currently, Cuba has two currencies, the Cuban peso (CUP) and the Cuban convertible peso (CUC). Cuban residents primarily use the CUP, while the CUC is used solely by tourists and is pegged to the dollar. Based on current exchange rates, the CUC is worth about 25 times more than the CUP. Most stores include both CUC and CUP prices on products, which can make purchasing items easier for tourists; however, some will price goods in one or the other, which can make transactions more difficult for individuals with the “wrong” currency. Both currencies are not exchangeable in foreign markets, and thus, can only be exchanged and used in Cuba.

Money Use in Cuba:

In society, money increases what can be produced and is an incentive. However, in Cuba virtually all of the industries and production are controlled by the government. Thus, although the banking system may hold a lot of money, the Cuban government does not allow for free enterprise or increased production like a laissez faire economy would. Additionally, bartering still occurs in rural parts of Cuba, particularly in agricultural transactions. For example, tobacco farmers can go to a market and barter their cigars with a farmer for their livestock or produce.

Since the government produces a certain amount of goods, production of goods is limited and essentially stagnant. Furthermore, the government pays fixed wages to people ($20-25 a month), who then have to go to specific stores to buy certain essential items (i.e. toothpaste, deodorant, laundry detergent, cooking oil, etc.). For example, from our personal experiences traveling in Cuba, we noticed a line of people waiting to purchase food items in one store, while another line was formed at a different store to buy personal hygiene items. Additionally, people waited in line at the telephone company office to pay their phone bills. It’s obvious that without money, the Cuban society cannot function; however, if the government allows for more production, the country can begin to grow and prosper.

Money Liquidity:

There are different types of money based on liquidity. Within Cuba, both currencies are very liquid and would fall into the M1 category. This is a major category in Cuba due to the currencies being nonexchangeable in any other markets. According to the CIA World Factbook, Cuba currently has $1.3 billion stock in narrow money (M1). Since the Central Bank of Cuba prints the money and is the only authoritative governing body that impacts monetary supply/policy, they are holding large less liquid deposits (broad money – M3), which amounted to $24.6 billion in 2013. This also includes cash, but is primarily all other savings deposits held by the bank. They also hold seniorage since they print the money, keep all the profits, and only distribute a limited amount to its people.

Tracking Money in Cuba:

Typically, there are three problems with using M1, M2, and M3 for tracking money over the long term. These include the following:

(1) Part of M1 that is held by individuals and entities outside the country. This does not exist for Cuba because the CUP and CUC is used only in Cuba.

(2) People switching from holding cash to putting cash in stock and bond mutual funds. Cuba used to have a stock market from the 1920s to 1959, but now the stock and bond markets don’t exist in Cuba.

(3) Use of debit and gift cards. These do not exist in Cuba, at least not for local residents. The tourism industry will only accept certain countries credit cards as payment. As a result, cash is still king in Cuba!

Outlook:

In Cuba, the government has full control over goods production and monetary creation and spending. Allowing an increase in production within various industries in Cuba will foster monetary spending, growth, and specialization. In 2013, the Cuban government has started considering unifying the CUP and CUC into one currency, which could simplify economic accounting and use of the currency. As trade relations continue to improve, if the Cuban government allows for the currency to be exchanged in the financial markets, having one currency will allow for greater tourism and simpler inflow of foreign investments. Also, the Cuban residents will no longer feel like their currency is significantly devalued (as they do now with the CUP being worth 25 times less than the CUC), and will be motivated to spend more, as the government ramps up production.

This period of time is very positive looking for investors, particularly as tourism increases and trading relationships continue to improve. As a result, Cuba will experience a higher demand for all goods and services. Not only will the infrastructure need to be improved, but also production of all goods and services will need to increase to cater to an inflow of people coming into/visiting the country. By having an easy to use money system, tourists and trading partners will be able to easily purchase goods and services in Cuba, while Cubans will be able to generate revenues and reinvest into their growing economy.

Sources: