Our Investment Decision:

Based on our fundamental research and economic analysis, we believe that present-day Cuba represents an attractive long-term investment opportunity for private equity capital. Our team views the country’s current economic condition and outlook as being ripe with unrealized growth potential and poised for continued expansionary growth in the near-term and a boom in the long-term.

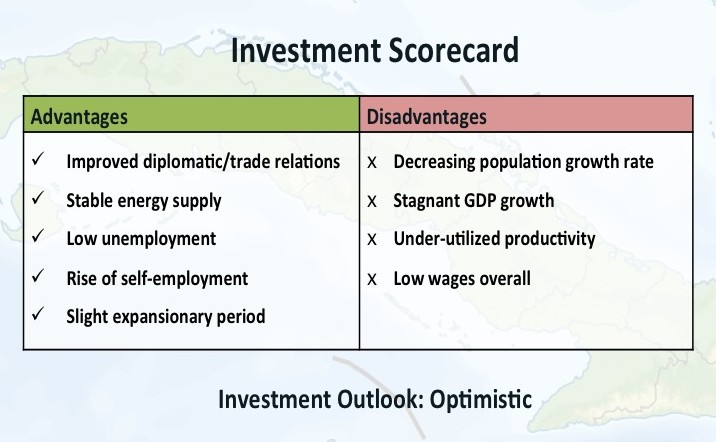

Investment Scorecard:

We concluded that Cuba has an optimistic investment and economic outlook by aggregating the economic advantages and disadvantages identified during our analysis into a SlateRock “Investment Scorecard.” While Cuba’s Scorecard contains almost the same amount of advantages (positive economic indicators) and disadvantages (negative economic indicators), we see the advantages (particularly the rise of self-employment and improved diplomatic/trade relations) as showing Cuba’s long-term economic potential. We believe that the current advantages will positively impact the Cuban economy by fueling GDP growth, increasing productivity, reducing emigration, and generating momentum that will help to turn around the disadvantages.

Next Steps:

We believe that the time to begin investing in the Cuban economy is now. Diplomatic relations with the United States are continuing to improve, which we view as a strong signal that embargoes may soon be lifted and that trading will open up. Key industries like construction, manufacturing, transportation, and hospitality are poised for rapid growth due to increased tourism and the rise of self-employment/small business ownership. As private equity investors, we have long-term investment horizons and want to get into Cuba before a before boom occurs. Deploying our capital now before a huge influx of foreign direct investment occurs will enable us to ride the upswing, capture more appreciation, and generate higher long-term returns for our investors.

We will be taking immediate action by beginning to structure the SlateRock Cuba 2016 Fund (the “Fund”). Our goal is to launch the Fund during the third quarter of this year, and then use the fourth quarter to select equity investments and acquire ownership interests in leading companies within our targeted industries. The Fund will be fully invested in the Cuban economy by January 2017.