Though it’s far from a sexy issue, social security is among the most important indicators of long-term financial stability of a country. As such it is a crucial factor to assess when looking to expand into a country, particularly one with a history of instability, such as Guatemala.

The benefits of social security are numerous and in many cases crucial to the overall welfare of a country. Social security in essence allows people who may not have been able to save money, or who invested poorly, to retire in their sixties without worrying (to an extent) how they’ll be able to survive financially. There are obvious societal advantages: older people are happier and in most cases more financially secure, loyal employers don’t have to continue to pay (or train) elderly employees whose skills are diminished but who need a paycheck, family members of older people don’t have to worry as much about supporting them, and many more.

But more interesting to us, are the factors that go into social security. On a micro level, the amount and percentage of social security paid by employers right now is of course of interest to us, but the factors that tell us the long-term viability of social security are what interest us the most. An aging population, such as that of the US, can put a strain on social security, requiring a government to either increase the social security tax, decrease the amount paid out to recipients, or take any one of a number of other actions, nearly all of which will create anger and/or a greater struggle for some segment of society. As business owners, from a social security perspective, we want to enter a market where the population isn’t aging, where social security taxes aren’t going up, and social security recipients are receiving just as much money (if not more) that they’ll be able to put into the economy.

The most recent information we have regarding social security in Guatemala comes from the 2013 report from the US Social Security Administration. For the sake of this post, and due to its vastly superior relevance (in terms of percentage of the population who utilize it), we will focus on old-age social security, rather than disability.

Despite an aging population that threatens its viability long-term (the impending doom-and-gloom scenarios espoused by many politicians is largely unfounded) the social security system of the United States has long been a model for developed countries. So it comes as a good sign that Guatemala’s Social security system has many similarities to that of the US.

Both are social insurance systems, both cover regular employees, self-employed persons and have a special system for many public-sector employees. Both also have similar rules for who is eligible. In Guatemala old-age pensions requirements are either 60 years of age with at least 18 years of contributions (for those first insured before 2011) or 62 years and at least 240 months (20 years) of contributions (for those first insured after 2011). The regulations in the US are slightly more complicated. Old-pension is eligible for those 66 years or older with at least 40 quarters of coverage (10 years), but early pension (reduced, paid from age 62) or deferred pension (increased, can be deferred up to age 70) options are available.

However, compared to the US, employers pay a lower percentage to social security (just 3.67% of covered payroll, compared to 6.2% in the US). The good news doesn’t stop there for potential businesses such as ours. In 2012 (the last year we have the information), contributions to social security by employees, employers and self-employed people is just 2.8%, compared to 34.9 in the US.

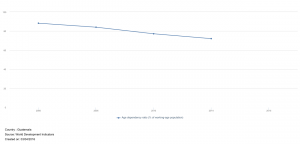

Perhaps the most encouraging signs, however, come from the World DataBank’s World Development Indicators, which show that the age dependency ratio (% of working-age population), exhibited below, is going down, while labor force participation rate among 15-64 year olds is increasing.

This combined with a rising population, a staggering 37% of which are 14 or younger (compared to just 19% in the US), makes it fairly unlikely that Guatemala will see any kind of social security crisis for the foreseeable future, which is an extremely appealing trait for a country that Finagle a Bagel (or any company for that matter) is considering entering into. In fact, all this figures show that, with an abundance of young workers or soon-to-be workers, social security costs may even go down.

Now, for a look at numbers that are going up, check out our page on Guatemala’s inflation here.