Fast Facts:

- Slight expansionary period, characterized by gradual real GDP growth, minor wage increases, and decreasing unemployment.

- Fiscal policy focused on increasing government spending.

- Improved diplomatic / trade relations.

- Consumer price increases (GDP deflator increasing).

- Negative population growth rate / emigration out of the country.

- Under-utilized productivity.

Overview:

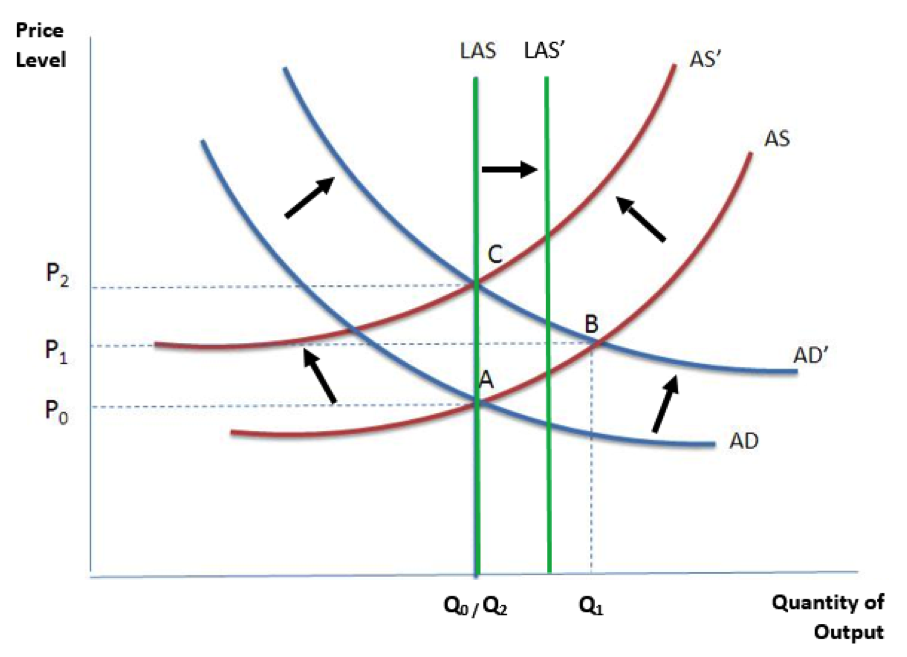

The Aggregate Demand (AD) – Aggregate Supply (AS) model looks to address a couple of major macroeconomic elements within a country. Specifically, the AD-AS model explains and tries to predict changes in business cycles, as well as what happens when unexpected or uncontrolled events shock the economy. We will summarize a number of macroeconomic factors that we have already analyzed in detail in order to determine the potential future economic situation in Cuba.

The AD curve shows the quantity of goods and services that households, firms, and governments want to buy at each price point, while the AS curve shows the quantity of goods and services that firms want to produce or sell at each price level. The Long Run AS (LAS), otherwise known as the natural rate of output, is vertical because it is not affected by short run changes in output. In the long run, the economy’s production depends on the amount of capital, labor, and land.

By analyzing the AD-AS model, we have identified a number of economic factors (some negative, others positive) that will have an overall positive effect on the model.

Cuba’s AS-AD Model:

Population growth is an important component of Cuba’s economic production. The growth rate has been declining over the past five decades and is currently slightly negative. The net migration of -1.48 people per 1,000, coupled with the fact that the youth population (0-14 year olds) has been steadily declining, starts to become alarming if the trend continues long term.

Additionally, Cuba’s productivity is extremely under-utilized. Its buildings and physical infrastructure is in need of major renovation. Its human capital and technological knowledge hardly impact the economy. Although the nation has a 99.8% literacy rate, not many people are enrolled in universities. Finally, Cuba has several abundant natural resources that are highly valuable exports, but it is trading with so few partners that it cannot reap the benefits.

GDP is a key driver of growth and demand in any country. The GDP and real growth rates have been gradually increasing, currently at 1.3% (in 2014), but at a decreasing rate. Additionally, the GDP per capita has been growing along with GDP, with a current growth of 2.5%, which is very close to real GDP growth. Subsequently, the GDP deflator has been increasing over the past 20 years, which indicates that prices are increasing. This makes sense as both GDP and GDP per capita have been increasing. Although very few inflation figures were available, we can infer from the GDP deflator that Cuba does experience inflation, which is currently around 4.4%. The economy is experiencing a slightly expansionary state.

Outlook:

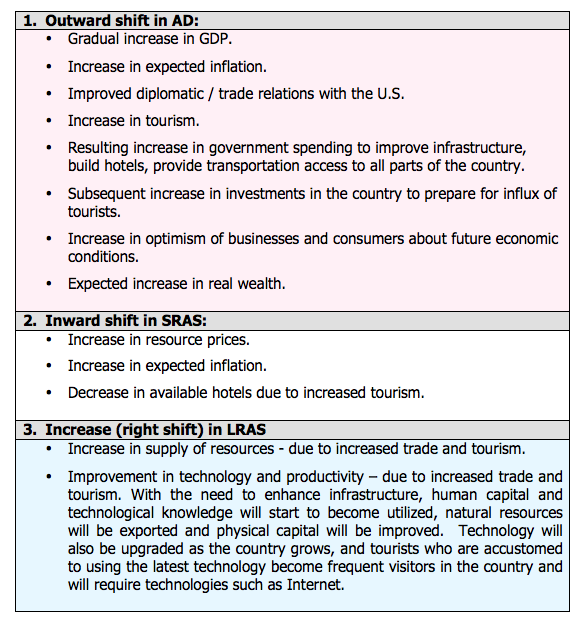

To tie it all together, Cuba is currently experiencing a major unexpected economic event that may change its outlook and economic status in the near and long term. President Obama’s visit to Cuba and his goal to improve diplomatic and economic relations, as well as foster trade and tourism with Cuba has the potential create a major boom within the emerging country. Opening up the border will generate an influx of people in the country, specifically tourists. These tourists will need hotels to stay in, infrastructure will need to be improved, reliable and available transportation will need to be established, and communication / connectivity (i.e. working cell phones, internet access, etc.) will need to be significantly enhanced. Tourists will be coming to enjoy the “forbidden” country and will look to spend their money all throughout the country. Additionally, improved trade relations will allow Cuba to monetize their natural resources, while importing currently scarce resources (e.g. cars) to further develop their country. Finally, the potential unification of the nation’s two currencies (the CUP and CUC) into one will foster spending, investment, and trade.

With that said, below is chart showing how we expect the AD-AS model in Cuba to shift in the following ways:

What we will find with these shifts is that both short and long term prices and quantity of output will increase. In the short term, quantity will first increase with an outward shift in AD, but will then be brought back to equilibrium with an inward AS shift. However, in the long run, with LAS shifting right, the quantity of output will increase, while price will drop a bit from P2 but will still be higher than P0 and P1.

What we will find with these shifts is that both short and long term prices and quantity of output will increase. In the short term, quantity will first increase with an outward shift in AD, but will then be brought back to equilibrium with an inward AS shift. However, in the long run, with LAS shifting right, the quantity of output will increase, while price will drop a bit from P2 but will still be higher than P0 and P1.

Sources:

The CIA World Factbook

The World Bank – World Development Indicators