Fast Facts:

– Cuba currently has very low GDP growth rates (1.3% as of 2013), which means that productivity is not being optimized.

– Using rule of 70, with an annual growth rate of 1.3%, it will take Cuba 54 years to double its GDP.

Four Key Factors to Productivity:

1. Physical capital: Despite its industrial sector fueling almost 25% of its GDP, Cuba does not have a very robust stock of physical capital. The nation’s buildings and physical infrastructures are very old in need of repair. There is virtually no new construction or rehabilitation of existing structures occurring. Furthermore, the majority of automobiles are several decades old and not very efficient.

2. Human capital: Cuba has an extremely high literacy rate of 99.8%. This indicates that virtually all adult members of the population (as defined as being 15+ years old) have the fundamental skill that is required to participate in a developed economy. However, human capital is low since few people are enrolled in universities. Increasing the availability of tertiary education would significantly increase human capital.

3. Natural resources: Cuba has several types of natural resources (i.e., petroleum, nickel, tobacco, sugar, and coffee) that are highly valuable exports.

4. Technological knowledge: Per Robert Solow’s estimate, about half of a nation’s growth output should come from its technical knowledge. However, despite Cuba’s high literacy rates, its technical knowledge is low due to the lack of prestigious universities and tertiary educational opportunities. As a result, the country is struggling to grow. This is evident in the decreasing GDP growth rate and decreasing population. Using the 2013 growth rate of 1.3%, it would take approximately 54 years for Cuba to double its GDP.

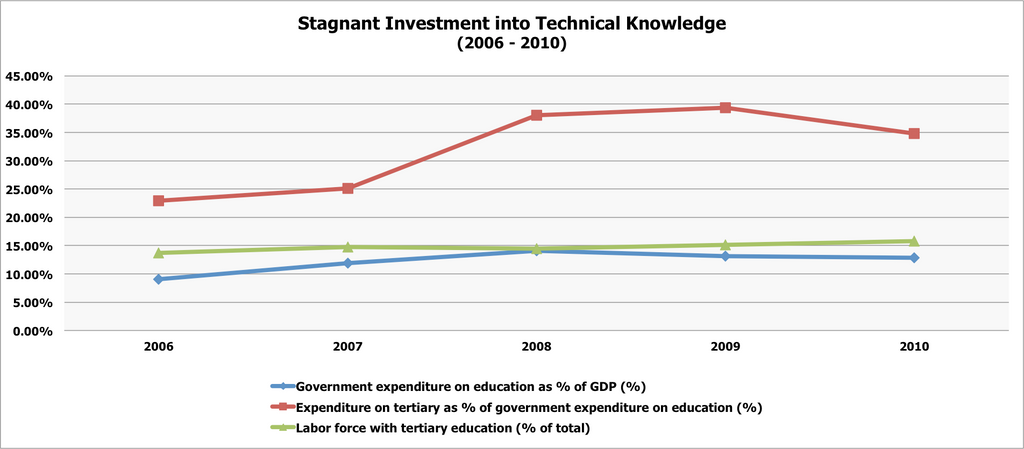

The graph below shows that government spending on education has been relatively flat over the past 10-15 years, while the expenditure on tertiary education as a percent of government spending on education has increased. Although the percentage of the total labor force with a tertiary level of education has been relatively flat, it has been slowly increasing. We see government spending on tertiary education as a valuable long-term investment in Cuba’s technical knowledge that will significantly raise productivity and fuel GDP growth.

Productivity Growth:

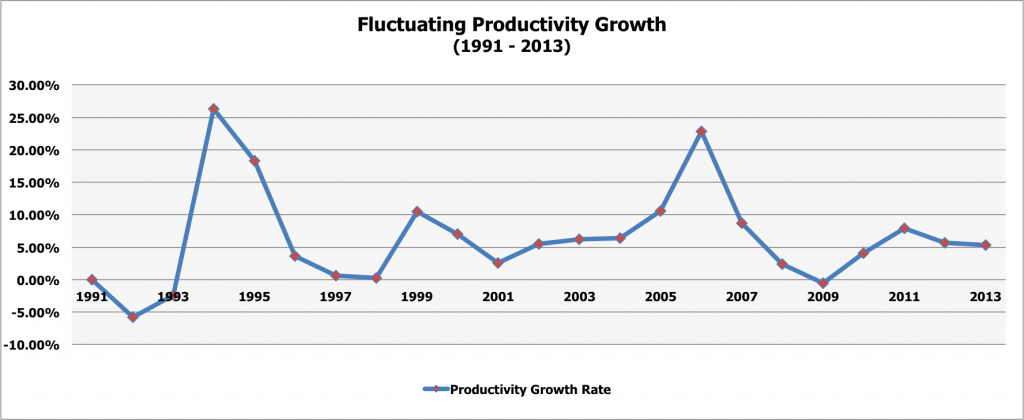

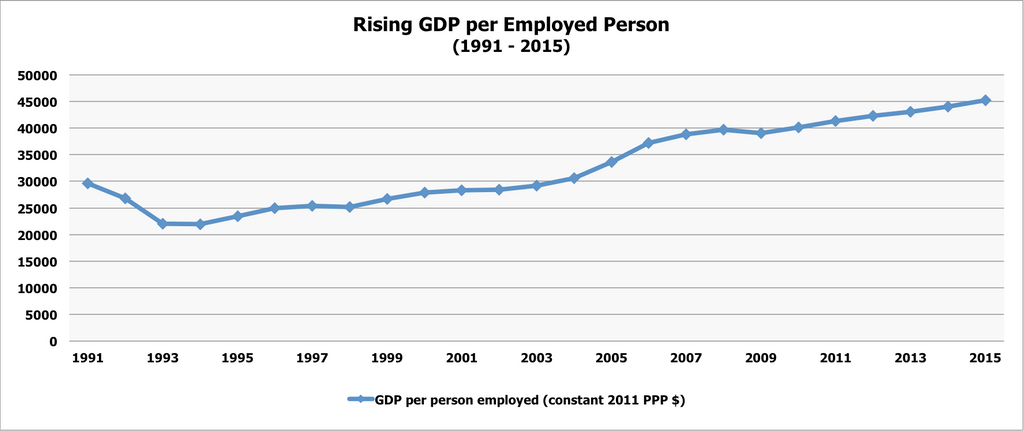

Productivity levels in Cuba have been very inconsistent over the past decade and a half. The graphs below show the GDP per employed person (15+ years old) and the productivity rate (GDP/population of employed people 15+ years old). Although the GDP per employed person for the most part steadily increased over the 1991-2015 year period, the productivity rate over this time period ranged from about -6% to 26% before leveling off at around 5% most recently in 2013.

As discussed above, the productivity growth rate has widely fluctuated over the past fifteen years. These fluctuations may be the result of a high percentage of the workers (15+ years old) being employed by the Cuban government or government-run industries, which would mean that such individuals would have job security even in times of recession. Despite the variations below, it is important to note that the average productivity growth rate from 1991 through 2013 was 6.63%.

Outlook:

Although productivity levels are currently unimpressive, we believe that productivity can be drastically increased. Since productivity is not being optimized and investment into the four key factors has been neglected, any efforts made by the government to increase productivity could yield significant improvements. We view Raul Castro’s recent announcement that all future annual wage increases will be tied directly to increasing productivity levels as a strong and positive signal that the Cuban government is focused on and committed to improving productivity and fueling GDP growth. Lastly, we view investing into efforts that will improve, restore, and replace Cuba’s deteriorating physical capital stock (e.g., investing in companies that do real estate development/construction or in industries like automobile manufacturing/repair) could yield high, long-term returns for foreign investors.

Sources:

The CIA World Factbook

The World Bank – World Development IndicatorsFox News Latino