Fast Facts:

– Cuba enacted its first set of social securities laws in the 1960s. The current laws were passed in 2008 and implemented in 2009.

– Social security program consists of two parts: (1) old-age and disability pension plans, and (2) maternity and family sickness benefits.

– Funding comes from a combination of employer and worker contributions. The government funds any deficit.

– The program is administered by the Ministry of Labor and Social Security. Applications are processed by local social security offices and work centers.

Overview of Cuba’s Social Security Program:

Like many developing and developed nations, Cuba has a social security program that is designed to provide financial support and assistance to its population. Cuba’s program consists of two types of benefits: (1) Old-Age, Disability, and Survivors pension plans, and (2) Maternity and Family Sickness benefit plans.

While the eligibility requirements for each plan vary, there are several commonalities between them. First, an individual must be an employed worker (or a qualified survivor of an employed worker) to meet the basic eligibility threshold. Second, an individual does not need to be a Cuban citizen to receive benefits, because many of the benefits are also payable to long-time Cuban residents. Third, none of the benefits are payable abroad. As a result, recipients must remain in Cuba in order to receive benefits. With respect to retirees, this means that an elderly person must spend his entire retirement in Cuba or forfeit his pension plan. With respect to disabled workers and survivors of deceased workers, this means that an individual (and consequently, his beneficiaries) must remain in Cuba in order to receive disability and survivors’ benefits. Requiring social security recipients to remain in in Cuba may help to prevent the net emigration rate from rising by significantly deterring elderly, disabled, and widowed/orphaned residents from leaving the country.

How is the program funded?

Cuba’s social security program is funded through a combination of employer and worker contributions with the government funding any deficit. Insured persons contribute 1% to 5% of their earnings to the program, while agricultural cooperatives contribute 5% of their profits from sales. Self-employed persons contribute 25% of their declared income, which is subject to a monthly minimum and maximum amount. Public sector employers contribute 12.5% of gross payrolls, while private sector employers contribute 14.5% of gross payrolls. Contributions made by insured persons, workers who are not self-employed, only fund the retirement/disability pension plans. However, contributions made by self-employed persons and employers fund both the retirement/disability pension plans and the maternity/family sickness benefit plans.

Summary of Old-Age / Retirement Plans:

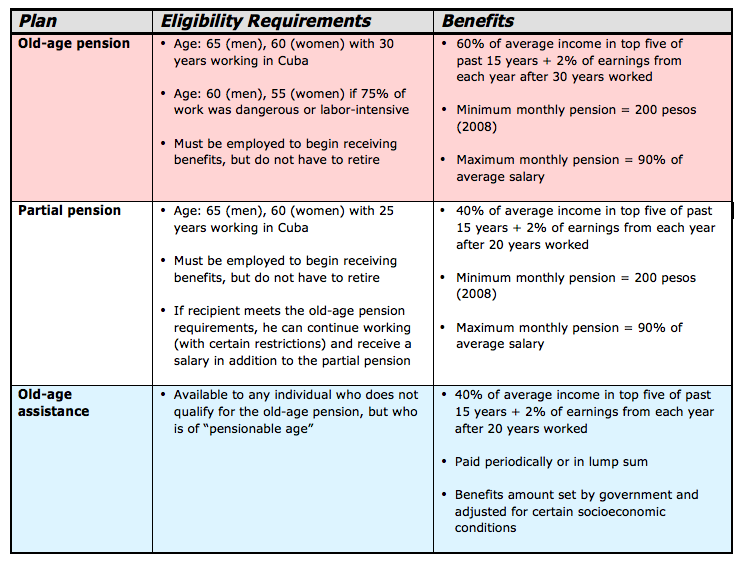

Below is a summary/excerpt of information that the United States Social Security Administration has compiled on Cuba’s three forms of retirement plans. For each plan, the chart below provides a high-level overview of the eligibility requirements and the financial support provided.

Dependency Ratios:

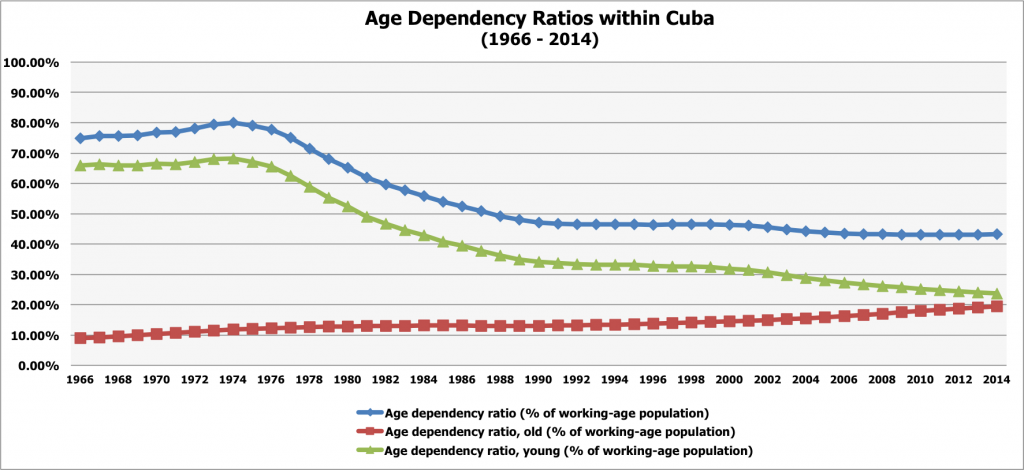

Dependency ratios are a metric that can be used to measure the percentage of a population that is likely to be economically/financially dependent upon others. When analyzing a government-run social security or retirement program, dependency ratios help to assess whether the nation’s population can continue to support its elderly citizens. Since the mid-1970s, Cuba’s overall dependency ratio has been decreasing. This means that there are more working-age individuals providing economic and financial support to each young (under the age of 15) and elderly (over the age of 64) resident. However, the dependency ratio for elderly citizens has been gradually increasing, which be could be attributed to Cuba’s population aging and life expectancy increasing. At the present ratios, and given the government’s willingness to fund any social security deficits, we do not feel that there is an strain on Cuba’s social security programs.

What is the economic impact?

The majority of Cuba’s population is eligible to receive financial and retirement insurance through the nation’s social security program. Due to the easy accessibility of pension plan benefits, we believe that most Cuban residents would review their retirement incomes as being safe and certain. As a result, we would expect that if industries like tourism and retail raise standards of living and increase wages, Cuban residents will be more likely to spend disposable income instead of saving. This would increase the marginal propensity to consume, while lower the marginal propensity to save.

Sources:

The CIA World Factbook

The World Bank – World Development Indicators

USA Social Security Administration