Fast Facts:

– Cuba has three main energy resources:

(1) Natural gas = fully produced and consumed within Cuba.

(2) Electricity = fully produced and consumed within Cuba.

(3) Crude oil = Cuba currently consumes more oil than it produces.

– Crude oil deficit is covered by importing shortfall from Venezuela and is payed for by exporting Cuban personnel and services, such as medical professionals and healthcare services.

– Venezuela is Cuba’s largest trading partner. Venezuela receives 33.5% of Cuba’s exports and forms 38.7% of Cuba’s imports.

Overview:

Cuba has been experiencing negative socioeconomic and economic trends. The estimated population growth rate for 2015 is -0.15%, which means that Cuba’s population is no longer growing. Furthermore, Cuba has a negative net migration rate, which means that more people are leaving the country than entering it. Finally, the real growth rate for GDP has been decreasing, from 3% in 2012 to 1.3% in 2014. The country is not producing as much as it used to, which could be directly attributed to the declining population rates. As a result, energy consumption is impacted negatively as well.

Supply & Demand:

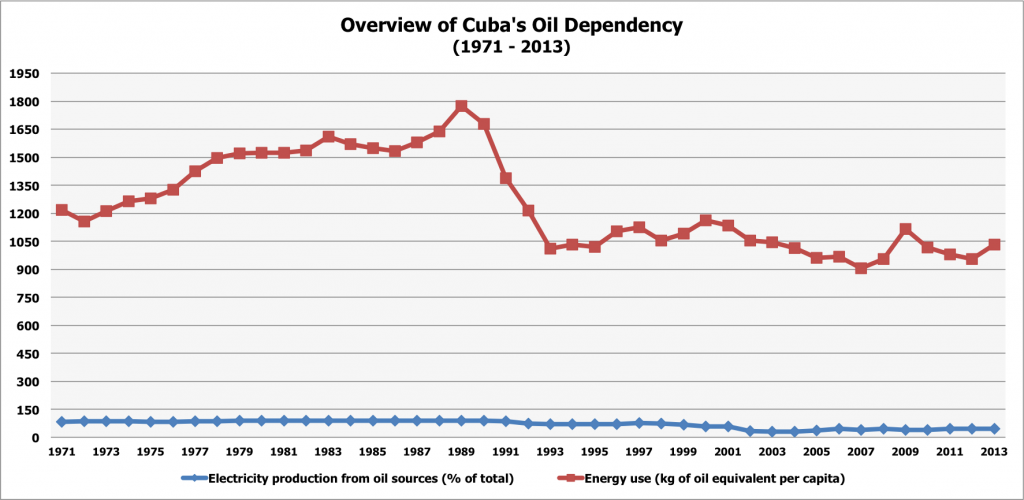

The three main energy resources in Cuba are natural gas, electricity, and crude oil. Natural gas and electricity are fully produced and consumed within the country. Cuba does not export or import any natural gas or electricity. Currently, 99% of electricity is generated from fossil fuels (primarily oil). However, over the past 40 years that dependency on oil to generate electricity has significantly decreased. Electricity production from oil sources was 82% in 1971, but was only 46% in 2012. With decreasing population and GDP growth rates and high oil prices, it makes sense that dependency and use of oil have decreased. We view Cuba’s ability to produce enough natural gas and electricity to meet its own consumption needs as an indication that the nation has a strong and sound energy supply.

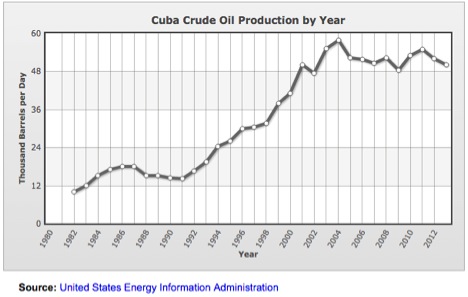

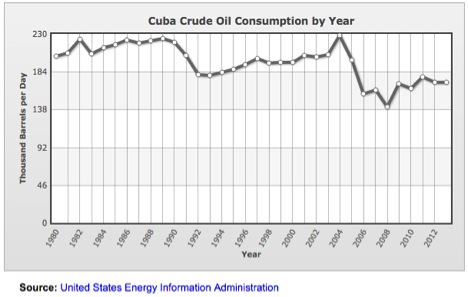

The charts below show the production and consumption of oil in Cuba since the 1980s.

Up until 2004, the consumption and production of oil in Cuba was high, with production growing at a rate higher than consumption (although barrels produced were much lower than consumed). However, over the past 10 years, both production and consumption of crude oil has been decreasing. The high for both hit in 2004, with production of 58,000 barrel/day and consumption of 229,000 barrels/day. Since then these figures have been decreasing. This behavior was consistent with the law of demand. Oil prices hit a peak in 2008 at $145/barrel and through 2014 have been stable at an average of $100/barrel. With the high prices, demand for oil has gone down in Cuba. Current production is at about 50,000 barrels/day, while consumption is at 171,000 barrels/day. The data is only available through 2013, so we cannot say whether the trend will continue or whether the sharp decline in oil prices (currently at $30/barrel) will encourage an increase in demand of oil in Cuba.

The law of supply also holds true in Cuba. As the prices have increased and stayed high, Cuban oil production increased as well, peaking in 2004. When prices are high, suppliers want to produce more in order to generate more profit. Since 2004, production has been decreasing slightly and staying fairly constant for the past 10 years. To account for its crude oil gap between production and consumption, Cuba imports crude oil from Venezuela, it’s biggest trading partner. This reliance solely on Venezuela is a risk, because if relations deteriorate between the two countries, Cuba will face a significant shortage of crude oil. In order to make educated and informed investment decisions, we also need to be aware of both countries’ economic situations and understand which key industries or target companies within Cuba heavily rely upon oil as an energy source.

Aside from high oil prices, a substitution effect may be another reason for the decrease in the production and consumption of oil. With the trade embargoes still in effect, Cuba’s automotive industry barely exists. The majority of vehicles on the road are classic American-made cars (and a smaller number of Russian-made cars) that were manufactured and imported approximately 50-60 years ago. The supply of vehicles is very low and the prices for these extremely old cars are very high. As such, very few people own or drive cars; the majority of people take public transportation.

With a nonexistent automotive manufacturing industry in Cuba, it makes sense that the demand for oil is decreasing. If trade relations continue to improve, importing foreign-made automobiles into Cuba could be an extremely lucrative business and viable investment opportunity. However, the success of an automobile importing business would be contingent upon whether Cuba’s supply of oil could meet the increased demand caused by increased car ownership.

Outlook:

With production being significantly lower than consumption in Cuba, it appears that they may have a shortage of oil, all other things held constant. The graph below (from WDI), shows this gap. Although the graph illustrates Electricity production (majority from oil resources) vs. Energy used (all oil), this gap would be very similar if Energy (oil) production was graphed, as electricity is dependent on oil.

Cuba has been able to close this gap between oil production and consumption by importing oil. Currently, Cuba imports 160,000 barrels of oil per day, which is approximately how much the country consumes (171,000 bbl/day). With production running at 50,000 bbl/day, Cuba is able to cover its consumption and also export about 74,000 bbl/day. So far this has been working for Cuba, but the situation may change in the near future. Currently, Venezuela accounts for approximately 34% of oil exports and 39% of oil imports for Cuba. With the large drop in oil prices, Venezuela’s economy has been significantly hurt, as they are a huge exporter of oil. In fact, in 2015 Venezuela imported light crude oil from the U.S. to mix in with their crude oil, which is much heavier. With Venezuela starting to depend on other nations for it’s oil revenues, their relationship with Cuba may weaken, and Cuba may have to either consume less oil, import from other countries or figure out a way to produce more.

Sources:

The CIA World Factbook

The World Bank – World Development Indicators

United States Energy Information Administration