This extended blog will mostly be of interest to Americans thinking about end of year tax strategies. It extends a discussion among some Yale colleagues about the current tax bill as well as some calculations based on web sources. This blog focuses on the new high standard deduction and the Alternative Minimum Tax (AMT) provisions, and what it means for charitable donations. Much of it is oriented toward income earners earning $150k-500k. There are of course many, many other features of the new tax bill not examined.

My glimpse at the new tax tables, included below, are that most people in the range from $150-500k will see tax cuts of their marginal rate of about 2-6%, unless they are affected by the AMT. Those affected by the AMT will see significant lump sum gains but marginal rates that are similar to this years, at 26 or 28 percent.

This discussion will be complex for many unless you are used to thinking about the tax subsidies for donations and the implications for timing of donation. (Most people donate because it just feels good.)

My bottom line is at the bottom of this email. COMMENTS/CORRECTIONS WELCOME.

I am not a tax expert and you should get expert advice before acting on anything you read here.

The standard deduction is proposed to be raised to $24,000 for a married couple filing jointly. More important are the AMT changes for high income people.

So under the new system a married couple can claim itemized deductions (look at Sch A of your return for last year for this amount) of a minimum of $24,000, ($12k if single) even if they have no itemized deductions.

The main itemized deductions for most people are mortgage interest, state and local income and property taxes, and charitable contributions.

Base case: Assume you don’t have any mortgage interest and your 2017 itemized deductions are say $40,000 in state income and property taxes, and $5,000 in charitable contributions:

Under current law you claim itemized deductions of $45,000 which is more than the standard deduction.

Under proposed 2018 law the allowable itemized deductions will be $10,000 state income and property taxes plus $5,000 for the donations. So if a person claims the standard deduction of $24,000 – he gets this regardless of whether he makes a charitable contribution of nil or $14,000. So the first 14k of charitable deductions doesn’t produce a tax benefit.

Wrinkle 1:

If you have deductible mortgage interest next year (Say $10,000) from an existing first mortgage next year, then the interest on it can be added to your $10,000 of local property taxes and the threshold for donations affecting your taxes would be only $4000. Since 10k+10k+4k=$24,000.

Wrinkle 1a: home equity line of credit mortgage interest is no longer deductible at all.

Wrinkle 1b: for any new mortgages taken out after Dec 15, 2017, only the interest on the first $750k of home mortgage will be deductible.

Important Wrinkle 2:

If your income is subject to the alternative minimum tax (AMT) for 2017 then the marginal value of a deduction this year is either 26 or 28 percent, depending on where you are in the phase out of the AMT, since these are the AMT income marginal rates. Your AMT is calculated from your income without taking most deductions but after a moderately large exemption. The AMT is based on your Alternative Minimum Taxable Income AMTI (See intuitive discussion below). Call this Y. Taxes are applied to Y minus the AMT standard exemption, call it Z, which is $84,500 for joint filers and $54,300 for others. The exemption starts to phase out once your income exceeds Q=$160,900 for joint filers, and $120,700 for singles. Under the proposed new tax bill, the AMT exemption (Z) is increased and the point at which the exemptions begin to be phased out are increased, but the tax rates remain the same. Z is decreased by $.25 for each dollar of AMTI above the phase out threshold Q.

The following focuses on joint filers and are based on a recent article by the Tax foundation (Link below).

Currently, if Y your AMT income is $160,900 then the AMT tax is

AMT=.26*(Y-Z) = .26*(160,900-84,500)=$19,864

If your AMT income is 250k then your AMT tax would be

Y=250,000

Q=160,900

Z = 84,500-.25(250,000-160,900) (reflecting the phase out of the exemption starting at 160,900)

AMT=0.28*(Y-Z) = .28*(250000-62225) = $52,577

If your income is 500,000 at which the exemption Z is currently fully phased out, then your AMT would be

AMT = .28*(500000 – 0) = $140k.

(The .26 rate applies when your Y = AMTI is less than $187,800, while the “higher rate” of 28% applies to more than that. This step also creates modest infra-marginal changes that I have ignored. Silly complexity…)

The current law raises the exemption amounts, and also raises the threshold at which the exemption starts to be phased out.

“Exemption amounts under the conference agreement are increased from their current level of $84,500 for joint filers and $54,300 for other filers to $109,400 and $70,300, respectively.”

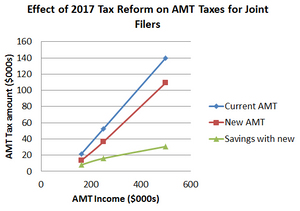

More importantly, the AMT exemption does not begin to phase out until alternative minimum taxable income exceeds $1 million for joint filing households. So for the three households just examined the new AMT amounts would be:

AMT only kicks in at AMTI >= 160,900.

At Y = 160,900: AMT=.26*(Y-Z) = .26*(160,900-109,400)=$13,390 a reduction of $6,474 from the existing AMT tax.

At Y = $250,000 AMT = .28*(Y-Z) = .28*(250,000-109,400)=$36,556 a reduction of $16,021

At Y=$500,000: AMT = .28*(Y-Z) = 0.28*(500,000-109,400) = $109,400 a reduction of $30,632

You can interpolate pretty well between these amounts using the following figure. The slight nonlinearity results from the change from 26% to 28% at Y=187,800.

These AMT amounts are only relevant when they are more than the taxable income calculated using the normal way (using deductions and the standard exemptions). For many, these AMT changes are the gifts of the current tax reform.

So the AMT, which currently affects about half of all HH with incomes above $200k is projected to affect a smaller number of people after the reform mostly because of the higher exemption.

This AMT change is a big cost component of the current reform, but gets less attention since it is harder to explain.

“All told, the Joint Committee on Taxation estimated that these [AMT] changes would reduce federal revenues by $637.1 billion over the next decade, compared to current law.” This is 42% of the total deficit increase!

https://taxfoundation.org/conference-report-alternative-minimum-tax/

Here is a brief, non-technical discussion of the Alternative Minimum Taxable Income AMTI.

Some of these items added back into your income include personal exemptions, state and local income taxes, miscellaneous itemized deductions and mortgage interest on home equity debt. Accordingly, you’re more likely affected by AMT if you have a high number of exemptions (a larger family), high state income and property taxes and/or high miscellaneous itemized deductions like significant investment management fees.

You may also have to include certain types of income that you wouldn’t normally count in your regular taxable income, such as exercising incentive stock options or tax-exempt interest from private activity bonds. The disallowance of deductions and addition of income leads to your Alternative Minimum Taxable Income (AMTI).

For 2017, you pay a tax rate of 26% on AMTI of $187,800 or less for those filing single, married filing jointly, head of household or qualify widower. For married filing separate taxpayers, the income threshold stops at $93,900. The tax rate grows to 28% of income over those amounts. Multiplying your AMTI minus your exemption times the corresponding tax rate gives you your tentative minimum tax.

You may have some additional tax due if you reported capital gains distributions, qualified dividends, and/or used the foreign tax credit, but your software should add those for you.

You should note that AMT is only the difference between your regular income tax and the tentative minimum tax amount calculated through AMT. For example, if you owed $30,000 in regular income tax and your tentative minimum tax amount was $33,000, AMT of $3000 will show up on line 45 of your Form 1040.

Here is another discussion from CBSNews.

What’s the deal with the alternative minimum tax?

For corporations, the AMT disappears.

That’s not the case for individual filers, but fewer will have to pay it, at least.

- Exemption amounts will increase from $84,000 for joint filers under the current law level to $109,400. Single filers will see that number increase from $54,300 to $70,300.

- The exemption currently phases out for joint filers at $160,900, and $120,700 for individuals. Under the tax bill, that phaseout would kick in at $1 million for married filers and $500,000 for those who are single. Above the threshold, filers lose 25 percent of their exemption, that is, $0.25 on every dollar in income.

What if I give to charity?

The charitable deduction will remain as it is. So, if you itemize your deductions, you may be able to deduct charitable contributions that are made to qualifying organizations. According to the IRS, you may deduct up to 50 percent of your adjusted gross income, although some filers are limited to 20 percent and 30 percent.

https://www.cbsnews.com/news/gop-tax-bill-how-the-new-tax-plan-will-affect-you/

Here are the current “final” tax rates and intervals as of 10:30 am Tuesday morning.

https://www.cnbc.com/2017/12/15/find-your-new-tax-brackets-under-the-final-gop-tax-plan.html

See below for a breakdown of the proposed income tax brackets for singles.

| Rate | Taxable Income Bracket |

| 10% | 0 to $9,525 |

| 12% | $9,525 to $38,700 |

| 22% | $38,700 to $82,500 |

| 24% | $82,500 to $157,500 |

| 32% | $157,500 to $200,000 |

| 35% | $200,000 to $500,000 |

| 37% | $500,000 and up |

Here are the proposed rates for married couples who file jointly.

| Rate | Taxable Income Bracket |

| 10% | 0 to $19,050 |

| 12% | $19,050 to $77,400 |

| 22% | $77,400 to $165,000 |

| 24% | $165,000 to $315,000 |

| 32% | $315,000 to $400,000 |

| 35% | $400,000 to $600,000 |

| 37% | $600,000 and up |

For comparison, here would be the 2018 brackets under current tax law, adjusted for inflation.

| Rate | Taxable Income Bracket-Single | Taxable Income Bracket-Married Filing Jointly |

| 10% | 0 to $9,525 | 0 to $19,050 |

| 15% | $9,525 to $38,700 | $19,050 to $77,400 |

| 25% | $38,700 to $93,700 | $77,400 to $156,150 |

| 28% | $93,700 to $195,450 | $156,150 to $237,950 |

| 33% | $195,450 to $424,950 | $237,950 to $424,950 |

| 35% | $424,950 to $426,700 | $424,950 to $480,050 |

| 39.60% | $426,700 and up | $480,050 and up |

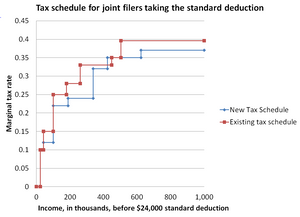

Here it is in a graph for joint filers. This assumes everyone just takes the standard deduction of $24,000.

Of course, low income people are not likely to have deduction that exceed the $24,000 standard deduction while high income people are more likely to. Most of the changes are only visible at the higher income levels…

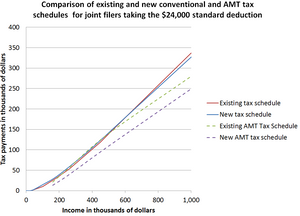

Putting together the new tax schedule with the new AMT taxes, and assuming joint filers only take the $24,000 standard deduction, the following reveals the key role that the new AMT plays.

For people who have lots of possible deductions under the new tax system, the AMT places a much lower minimum on tax payments than the old one.

The new AMT schedule is substantially more attractive to high income salary earners affected by the AMT. The relevant tax rate for them is 28%.

Not shown in this figure is that eventually the difference between the existing and new AMT disappears at about $1.4 million.

My bottom line from this is:

In general, under the new tax program, bunching of charitable donations and concentration of deductions into a single year will be attractive, so that you might take the standard deduction one year and not the next.

The AMT makes it unclear whether bunching in 2017 is particularly worthwhile relative to 2018, since the 26% or 28% rates in the AMT may be less than the new marginal rate next year when combined with a more favorable AMT in future years. In short, a large donation this year may mean that on the margin you only get a 26-28% tax subsidy, while a donation next year may have a 33-37% deduction for large donors with moderately high incomes (<$500k).

For salary earners not affected by the AMT, donations this year are likely to be more favored than next year, when the lower rates and higher thresholds for tax rates will matter.

If you want to take a deduction for a donation THIS YEAR but decide who it goes to next year, you could open a Donor advised fund, such as at Fidelity.

My bottom, bottom line is that I don’t expect large tax savings from moving around deductions between this year and next if you are affected by the AMT. A good strategy is to give what feels right.

Of course, all of this is based on the current tax bill, which could change or not be passed…

Get TAX ADVICE BEFORE YOU RELY ON THIS INFORMATION!

(This warning is mostly to protect me in case I am wrong.)